Precious Metals Commission provides a global overview of sector, focusing on ethics, the environment, health and hallmarking

ABOVE: Sara Yood, Deputy General Counsel of the Jewelers Vigilance Committee in the United States, addressing the Precious Metals Commission on November 3, 2021.

Huw Daniel, CIBJO Precious Metals Commission President.

Karina Ratzlaff, CIBJO Precious Metals Commission Vice President.

NOVEMBER 4, 2021

CIBJO’s Precious Metals Commission met in formal session at the 2021 Virtual CIBJO Congress on November 3, 2021. The meeting on Zoom was moderated by Commission President Huw Daniel, assisted by Vice Presidents Karina Ratzlaff and Sara Yood, Deputy General Gounsel of the Jewelers Vigilance Committee (JVC) in the United States.

Mr. Daniel led a thorough exploration of the main issues affecting the worldwide precious metals trade, from developments in the ethical and legal arenas, to sustainable development, an update on the U.S. Federal Trade Commission’s guides as well as the FTC’s decision to reduce gold purity below 10 karats, the review process in Europe regarding silver toxicity, and gold hallmarking in India.

The meeting began with Ms. Yood speaking on the “Changing Legal and Ethical Landscape” and the implications for how precious metals are labelled and marketed. She said governmental bodies have increasingly been focusing on mineral supply chains during the past several years due to anti-money laundering and terrorist financing risks, but also because of an identified reluctance by governments in some countries to respect tribal land and prevent mining in those areas.

“The U.S. Treasury Department is very focused on supply chains and how illegal activity can run through them,” she commented.

She then spoke about the increased reliance of firms in the jewellery supply chain on recycled metal. She also mentioned the issue of some countries dominating the supply chain for minerals, such as China with cobalt, has pushed the new Biden Administration to look closely at how the United States can reduce its reliance on these supply chains.

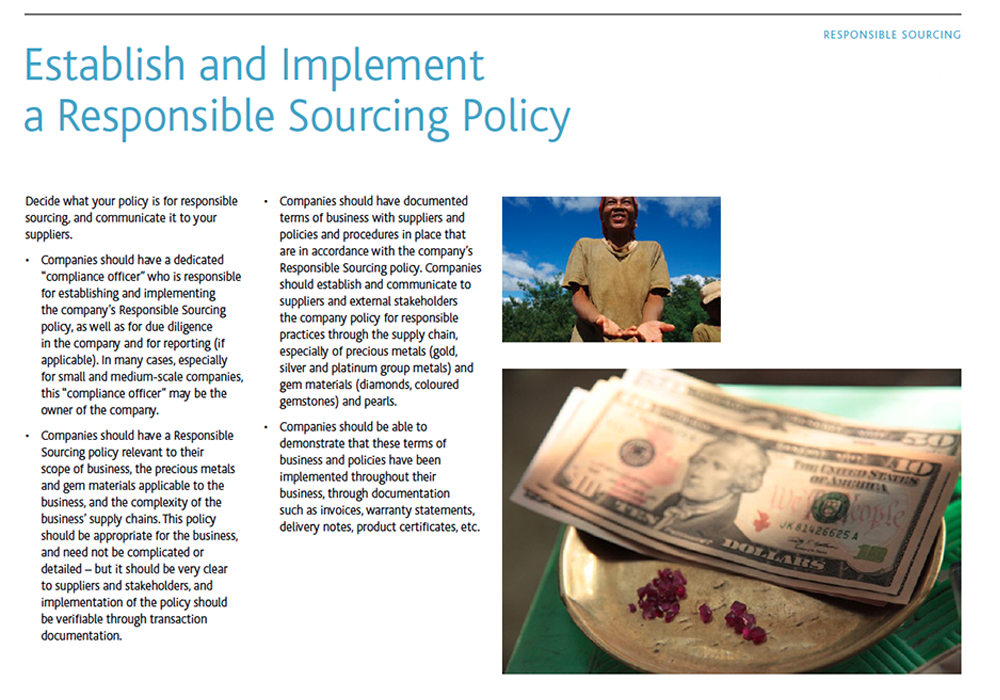

Philip Olden, President of the CIBJO Responsible Sourcing Commission, then spoke on the evolution of responsible sourcing to sustainable development and CIBJO’s response on the issue. He said use of the CIBJO Responsible Sourcing Blue Book (CLICK TO DOWNLOAD), and more recently the Responsible Sourcing Tool Kit (CLICK TO ACCESS DEDICATED WEBSITE)that was introduced earlier this year should be encouraged. CIBJO now provides all the tools needed by firms to ensure that they are not aiding illicit trade in precious metals, he commented. “All national associations should ensure members are using and reviewing the resources. The Responsible Sourcing Blue Book has been the most reviewed of CIBJO’s Blue Books.”

Other developments mentioned by Olden included updates by industry bodies, such as the London Bullion Market Association (LBMA), relating to silver and gold refiners which must adhere to the LBMA’s standards and correct management of internal bullion centres. “The LBMA recognises ongoing reports from civil society groups, the media and the Financial Action Task Force on the use of gold in particular, but also other precious metals in the funding of terrorism and illicit trading. We must support the work of these trade associations aiming to eliminate such activity,” he stated.

Mr. Olden also spoke about the pressures on the mining industry, which will find it increasingly difficult to secure financing, particularly for miners of minerals from which discretionary products are made, such as jewellery which accounts for most demand for gold.

“We should expect to see more members of our industry using recycled sources rather than mined. There is plenty of supply of gold, for example, with 200,000 tons of gold in ‘above the ground stocks.’ And there is lots more gold sitting in safes, vaults and drawers around the word so its possible we will see recycled gold as the major source of supply. We need to build our sourcing guidance for the industry to reflect these changes,” he stated.

Mr. Olden added that the industry is looking at tighter definition of recycled materials and there is growing pressure to extend responsible sourcing into the recycled market due to the growing trade in recycled materials, which is widespread in Europe and the United States, where some refiners only use recycled gold.

Ms. Ratzlaff mentioned that in Germany more than 90 percent of gold is recycled and that there is a low environmental impact due to strict German rules regarding recycling.

Mr. Daniels concluded the discussion by saying that the jewellery industry should be cautious about making green claims about recycling, as we would not want to become the target of a “dirty-recycling” attack, and must ensure that it works to retain consumer confidence in both mined and recycled metal.

Ms. Yood updated the commission on the latest developments regarding the Federal Trade Commission’s (FTC) guides regarding advertising for jewellery, and many other industries in the USA. Following the election of the Biden administration there have been big changes at the commissioner level, which is very vocal about anti-trust issues, she said.

The FTC will be reviewing green guides relating to all industries in 2022, especially on green and environmental claims for products. She mentioned how in 2019 the FTC wrote to lab-grown diamond and diamond simulant makers about their advertising and environmental claims. “So, the guides are very important and firms must be in line with them.

“In addition, the definition of ‘recycled’ might be at play in the guides. In the U.S. there are no recognized definitions in the guides about sustainability. From what we have heard the FTC is interested in that. The FTC’s jewellery guides were last revised in 2018 and must be done every 10 years,” Ms. Yood said.

Ms. Ratzlaff spoke on the current review process in Europe for the classification of silver toxicity and the implications due to the large use of silver in jewelry, watches and silverware. She said the classification could have an impact on alloys containing silver.

She added that if silver does get so classified then the implications are quite severe for silver products in Europe. “We need to wait for the results of the review and then press our governments to support us,” she stated.

Mr. Daniels provided the commission a review of the Indian government’s requirements for gold hallmarking. The Bureau of Indian Standards has issued new rules with a timeline for when they should be adopted. Previously, there was no mandated requirement for the hallmarking of gold in India, but the changes are due to the vast informal gold sector in India, having varying degrees of compliance. Mandatory hallmarking is being carried out in three phases, he said, adding that the government has pushed back the mandatory hallmarking start from August 2021 to November 30.

“The Indian jewellery industry has been active in voicing concerns on the one hand as well as in cooperating. Companies in the organised trade, such as large corporations are already in compliance. It is more of an issue for the informal trade which the government would like to bring in to closer compliance and avoid issues such as under-karating. The industry is expecting a huge amount of paperwork and backlogs are likely,” he said.

Ms. Yood spoke about the FTC’s reduction of gold purity to below 10 karats in its revised jewelry guides in 2018 and how CIBJO should respond. “This move has not had a sea-change effect and I would not recommend challenging it. It would take a lot of money and resources to find consumer data to present to the FTC on the issue. I would wait till the 2028 guides revision.

“Some firms have raised concerns, but there has been no big push. JTV pushed for the FTC move, to be able to sell its lower-cost products and Indian close-out jewellery of 9-karat goods. The FTC’s justification for the move was to balance the commercial concerns against the 1st amendment in the U.S .,which says the government cannot prevent free speech,” she stated.

Wrapping up the meeting, CIBJO President Gaetano Cavalieri said that it would be best to respond to the FTC by working with the JVC for a harmonised response, adding that CIBJO is at the disposal of the JVC on the matter. He also pointed out that the world is going in a clear direction regarding ethical behaviour and sustainable development.

“Our industry and especially CIBJO is far ahead of many other industries in the world in these respects. Our presence is recognised by the bodies of the UN and its senior officers. We are recognised as one of top five organisations in the world working to bring about the 2030 agenda of Sustainable Development Goals,” the CIBJO President said.