CIBJO releases set of guidelines for measuring

ESG performance in the jewellery supply chain

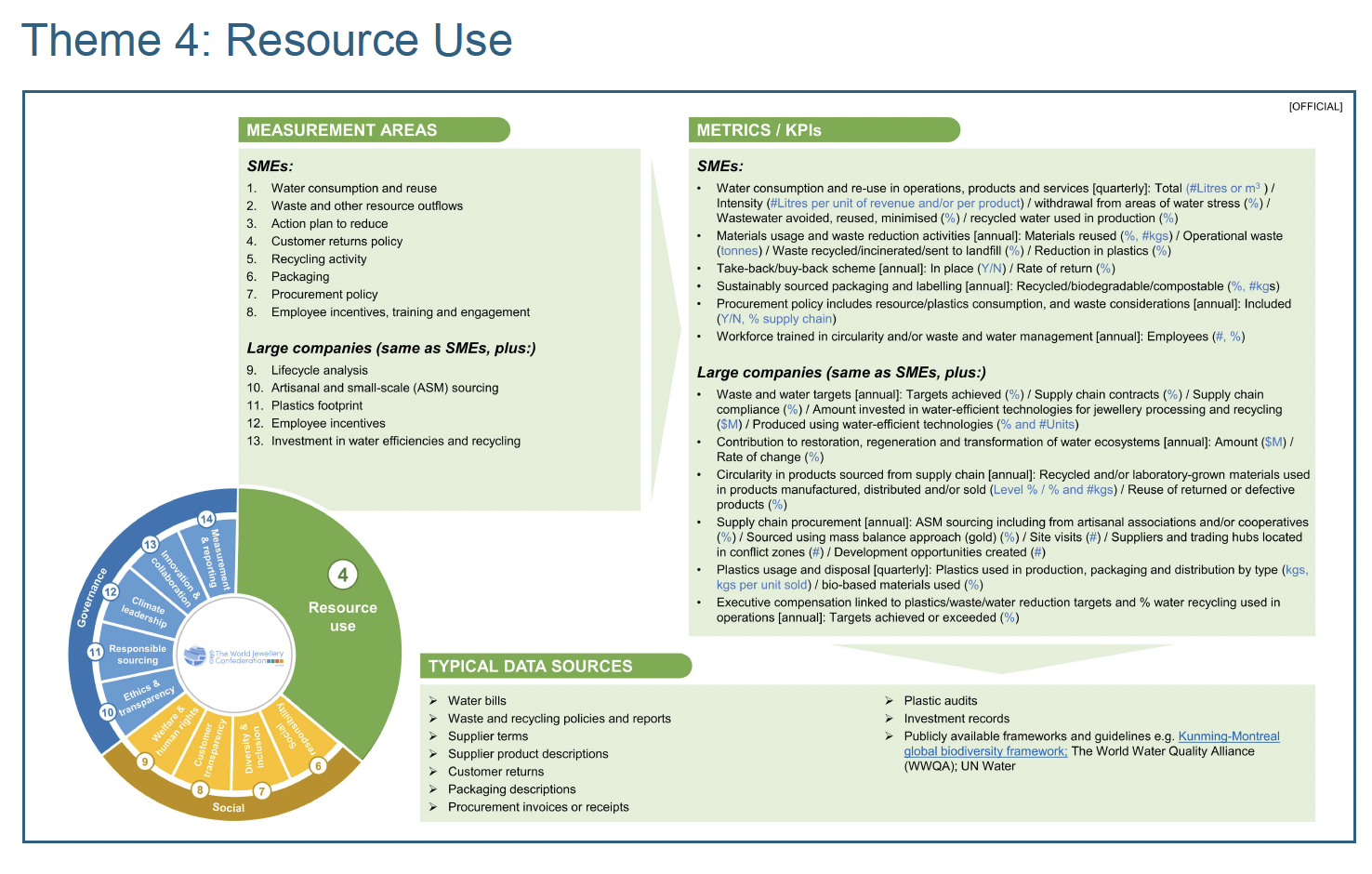

A page from the newly released ‘CIBJO Guidelines for Measuring ESG Performance,’ now available for downloading from the CIBJO website. The page outlines methods of measuring a company’s use of water resources and non-renewable waste products.

FEBRUARY 6, 2025

One year after its release of a breakthrough guidance document that first outlined environmental, social and governance (ESG) principles for the jewellery industry, the World Jewellery Confederation (CIBJO) has followed up with a set of guidelines for measuring ESG performance in the distribution chain. And while the first document was geared primarily for companies handling laboratory-grown diamonds, the new document’s recommendations can be applied in different parts of the industry and distribution chain, and by larger and smaller companies.

Called the “CIBJO Guidelines for Measuring ESG Performance,” like the first ESG document the new guideline was developed by the CIBJO Laboratory-Grown Diamond Committee, headed by Wesley Hunt, working with independent advisers, Key & Co., who collaborated closely with CIBJO’s Sustainable Development Commission, headed by John Mulligan. It was authored by ESG experts Jon Key and Helen Mitchell, and was first presented at the 2024 CIBJO Congress in Shanghai, China, in November 2024, and again at the VicenzaOro jewellery show in Vicenza, Italy, in January.

The ESG measuring guidance document is now available for downloading at no charge on the CIBJO website. To obtain the document, PLEASE CLICK HERE.

The measurement guidelines are bult around 14 environmental, social and governance (ESG) themes, identifying between four and 16 measurement areas, as well as sample metrics for each theme. They represent a subset of widely used measures relevant to the jewellery industry, to enable companies to take action.

In preparing the guidelines, CIBJO recognised that the jewellery industry and value chain are highly fragmented, diverse and multi-layered, and that there are significant differences in practices and differing levels of sophistication between countries and sectors, including precious metals and gemstones. The guidance document takes into account that some sectors such as coloured gemstones, are dependent on artisanal mining sources and SMEs, which can make ESG measurement more challenging.

The new guidelines also present a 10-step approach for members of the jewellery industry on their ESG journey, and also a glossary of terms explaining what to many may be new and confusing terminology.

The new guidelines are aligned with CIBJO Blue Books and other resources, such as the CIBJO Sustainable Development Commission’s ESG and sustainability roadmap, which will be published in the near future as a Blue Book. It also complements other ESG initiatives underway, such as that of the Watch and Jewellery Initiative 2030.

It should be noted that the new CIBJO guidelines are recommendations and the document should not be regarded as a compliance mechanism in and of itself. However, it does relate to a growing body of regulatory requirements to which the members of the industry in different countries are becoming subject to. Last June, the European Commission enacted the first set of ESG regulations, which by January 2027 will require all listed SMEs with more than 10 employees, and assets worth more than 25 million euro or turnover higher than 50 million euro, to assess and disclose the environmental, social, and governance (ESG) factors that influence their impact on climate-related and financial risks.

“This a very significant guidance document, which we a pleased to be able to make freely available to all members of the industry,” said CIBJO President Gaetano Cavalieri. “We have have many years promoted the introduction of strict corporate responsibility and sustainability practices in the international jewellery industry, but ESG is taking things to a different level, transforming what once were mainly recommended principles into legal obligations. As an industry we need to be prepared, and the ‘CIBJO Guidelines for Measuring ESG Performance,’ are an important step in that process.”